Earlier in the week Preservation Maryland updated its members and supporters on some of the initial legislation the organization is following and supporting. On Wednesday, January 17, Governor Moore’s proposed Fiscal Year 2025 operating and capital budgets were...

Results for "historic tax credit"

Governor Hogan Signs Historic Tax Credit Bill Into Law

Preservation Maryland’s Director of Government Relations Elly Cowan joined Senator Katie Fry Hester and Isaac Meyer from Compass Government Relations Partners in Annapolis May 16, 2022 as the Historic Revitalization Tax Credit – Funding and Extension (SB289/HB27) was...

In Print: Advocating for Increased Funding for the Historic Tax Credit Program

Director of Government Relations Elly Colmers Cowan penned the op-ed Viewpoint: Maryland is falling behind in funding historic preservation tax incentives, featured in today's Baltimore Business Journal. Elly writes about the value the Historic Tax Credit program...

Maryland State Historic Tax Credit to Support Six New Rehabilitation Projects

As a result of Preservation Maryland and its many partners’ ongoing advocacy, six projects across Maryland recently received over $9 million in historic tax credit funding. As a result, over $73 million worth of projects will move forward – underscoring the...

Preservation Primer: Historic Tax Credit

Finding funds for your preservation rehabilitation project can be complex and confusing. Fortunately, in Maryland, there are many programs designed to help private property owners maintain and rehabilitate their historic structure. Historic tax credits are a critical...

National Park Service Releases 2020 Historic Tax Credit Economic Impact Report

The National Park Service recently released their Federal Tax Incentives for Rehabilitating Historic Buildings Annual Report for FY 2020, and it shows that despite the unprecedented year, the federal historic tax credit was able to have a positive impact for historic...

Action Alert [HB865/SB659]: Maryland’s Small Commercial Historic Tax Credit Must Stay Active

Maryland's Small Commercial Historic Tax Credit program has run out of money and requires immediate funding. This week, Senate and House committees will hold hearings for HB865/SB659 that would extend the life of this vital program by increasing the authorized funding...

Maryland State Historic Tax Credit to Support Seven New Rehabilitation Projects

As a result of Preservation Maryland and its many partners’ ongoing advocacy, seven projects across Maryland recently received over $9 million in historic tax credit funding. As a result, over $33 million worth of projects will move forward – underscoring the...

Advocacy Alert: Urge Your Baltimore Councilperson to Support the City’s Historic Tax Credit

In late August, the Taxation, Finance, & Economic Development Committee of the Baltimore City Council returned a favorable report on Council Bill 20-0552, which extends the city's historic tax credit through 2022. The bill now moves on to the full City Council,...

New City Council Bill Would Extend Local Historic Tax Credit Program

The City of Baltimore is currently considering a bill that would extend its historic tax credit through February 2022. City Council Bill 20-0552 Tax Credits – Historic Properties extends the period within which applications may be accepted for the tax credit for...

House Passes Federal Historic Tax Credit Improvements in Infrastructure Package

The House of Representatives has passed The Moving Forward Act (H.R. 2), a comprehensive infrastructure bill that includes enhancements and temporary emergency measures for the federal Historic Tax Credit, thanks in part to the advocacy of Preservation Maryland and...

Recent Federal Report Shows Positive Impact of Historic Tax Credit Program

In March, the National Park Service released their latest Annual Report on the Historic Tax Credit program, the largest Federal investment in historic preservation. Twenty-five Historic Tax Credit projects received their final application approvals in Maryland in 2019...

Maryland’s State Historic Tax Credit is a Ready-Made Tool for Economic Recovery

Maryland's historic tax credit is a ready-made tool for economic recovery in the wake of the coronavirus pandemic. Preservation Maryland is hard at work to ensure that the Historic Rehabilitation Tax Credit remains funded for FY21. In light of the immense challenges...

Maryland State Historic Tax Credit to Support Eight New Rehabilitation Projects

As a result of Preservation Maryland and its many partners' ongoing and sustained advocacy, $9 million more historic tax credit projects were recently funded across Maryland. As a result, over $180 million worth of projects will move forward – underscoring the...

New Numbers Show Economic Impact of Federal Historic Tax Credit in Maryland

Rutgers University and the National Park Service released the latest Annual Report on the Economic Impact of the Federal Historic Tax Credit. The data from fiscal year 2018 compiled in the document describe the positive impact of the historic rehabilitation projects...

Op-Ed: Historic Tax Credits Need More Funding

On Monday, January 7, 2019, The Baltimore Sun published an Op-Ed by Preservation Maryland Executive Director, Nicholas A. Redding, calling for stronger support for the state Historic Tax Credit. The full Op-Ed can be read on the Baltimore Sun website. A selection of...

Maryland State Historic Tax Credit to Support Five New Rehabilitation Projects

As a result of Preservation Maryland's ongoing and sustained advocacy $9 million more historic tax credit projects were funded across the Old Line State. As a result, nearly $58 million worth of projects will move forward – underscoring the importance of preservation...

Support the Historic Tax Credit Enhancement Act

Last year, Preservation Maryland and our partners from across the country worked with members of Congress to retain the Historic Tax Credit (HTC) in a reformed tax code. While we were successful in keeping the HTC as a permanent tax credit, the credit is now taken...

National Park Service Releases Annual Historic Tax Credit Economic Impact Report

The National Park Service recently released their Annual Report on the Economic Impact of the Federal Historic Tax Credit for FY 2017 and its good news for historic communities across Maryland and around the country. POSITIVE ECONOMIC IMPACT In 2017, the Park Service...

New Federal Historic Tax Credit Legislation Introduced

On June 13, Maryland Senator Ben Cardin joined with a bi-partisan group of legislators from around the nation to introduce legislation that would substantially improve the federal historic tax credit. The new legislation would enhance the value of historic tax credit...

New Environmental Issues Guide includes Historic Tax Credit Funding

The Maryland League of Conservation Voters Education Fund has just released a report, Vision 2025: Issue Guide, outlining major conservation issues that Maryland will face over the next four years - including the Historic Tax Credit. From the Report: Conserving open...

Advocacy Alert: Ask Your Legislators to Support the Historic Tax Credit

Preservation Maryland has been working hard on two important pieces of legislation to improve our state Historic Tax Credit program. With the Maryland General Assembly in Session for just over a month more, now is a great time to contact your legislators and ask them...

Historic Tax Credit Funding Bill Included on Environmental Hot List

A pro-preservation piece of state legislation in support of increased funding for the state Historic Tax Credit has been picked up by the Maryland League of Conservation Voters as part of their influential weekly list of bills that impact Maryland's environment —...

New Legislation to Enhance Maryland’s State Historic Tax Credit Announced

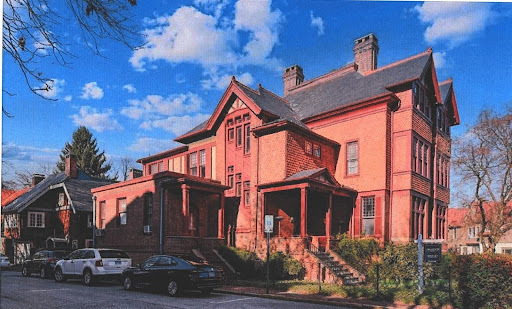

On January 8, 2018, Senator Bill Ferguson of Baltimore City's District 46 announced two new pieces of legislation that, if passed, will strengthen this key revitalization and community development tool. Senator Bill Ferguson made this announcement at an event...

Maryland State Historic Tax Credit Projects to be Announced in Baltimore

On Monday, January 8, 2018 at 2PM at the historic I.C. Isaacs & Co. complex, community development and preservation advocates will join with elected officials to celebrate the planned rehabilitation of the former manufacturing facility and to call on state leaders...

Federal Historic Tax Credit Retained in Final Tax Reform Bill

After months of nationwide advocacy focused on saving the Federal Historic Tax Credit, preservationists rejoiced late Friday evening to learn that the credit was retained in the final iteration of the bill. The preservation community worked diligently to assure the...

Advocacy Recap: Preservation Maryland hosts National Historic Tax Credit Telephone Town Hall

On Tuesday, December 5, 2017, Preservation Maryland hosted a live telephone town hall that reached thousands of listeners to discuss the latest threats to the federal Historic Tax Credit and how we can all be advocates for this essential program. If you missed the...

Baltimore and Cambridge Call on Congress to Save Historic Tax Credit

The City of Baltimore and the City of Cambridge, Maryland both recently adopted resolutions calling on Congress to save the critically important federal Historic Tax Credit. The resolutions, which were provided to the councils by Preservation Maryland, underscored the...

Emergency Historic Tax Credit Telephone Town Hall Open to the Public

On Tuesday, December 5, 2017 at 7pm EST, Preservation Maryland hosted a free Telephone Town Hall to discuss the current threats facing the federal Historic Tax Credit program. Update: A recording of the Telephone Town Hall is now available online. Listen Now...

Advocacy Alert: Federal Historic Tax Credit Eliminated

The Federal Historic Tax Credit was eliminated in the draft tax reform bill released by the House of Representatives Ways & Means Committee on November 2, 2017. Advocacy Video Our Executive Director, Nicholas Redding, and Director of Engagement, Elly Cowan,...

Events

Preservation Maryland participates in and hosts many events in and around Maryland. Take a look at our upcoming events to see where we’ll be next.

![Action Alert [HB865/SB659]: Maryland’s Small Commercial Historic Tax Credit Must Stay Active](https://preservationmaryland.org/wp-content/uploads/2021/02/krug-storefront-CREDIT-baltimore-heritage-2011.jpg)