The National Park Service issued two reports highlighting the successes of the Federal Historic Preservation Tax Incentives Program this week.

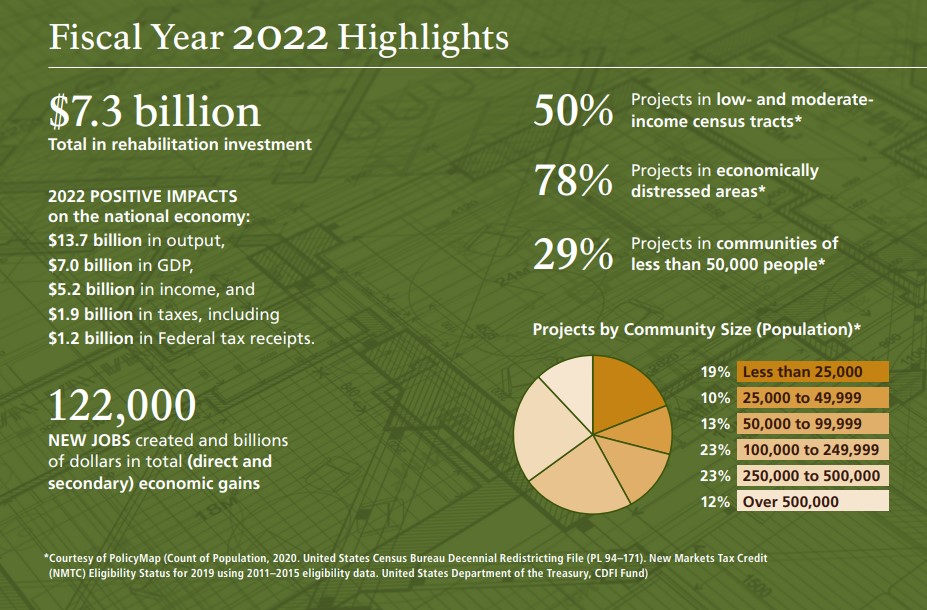

The NPS issued a press release about the Annual Report on the Economic Impact of the Federal Historic Tax Credits for Fiscal Year 2022 prepared in collaboration with the Rutgers University Center for Urban Policy Research. The Center analyzed the economic impacts of the historic tax credits on the national economy, and, as the report identifies, the level and breadth of the economic impacts resulting from the Federal HTCs in FY 2022 are quite significant. The report also includes information on the cumulative economic impact of the Federal HTCs for the past 45 years, starting in 1977–78 with the first completed rehabilitation project to be certified by the NPS under the program.

The second report, Federal Tax Incentives for Rehabilitating Historic Buildings Annual Report for Fiscal Year 2023, focuses on the program’s accomplishments in the last fiscal year. Program activity remained high, and nearly half (46%) of all certified rehabilitations were under $1 million in Fiscal Year 2023. Estimated rehabilitation costs totaled $9.49 billion for preliminary certifications and $8.81 billion for final certifications. Since 1977, the historic preservation tax incentives have generated a total of $131.71 billion in estimated rehabilitation investment in 49,2633 rehabilitation projects.

Preservation Maryland has long advocated for the Federal Rehabilitation Tax Credit and touted its benefits to communities across Maryland, aiding redevelopment projects, the creation of jobs, generated hundreds of millions of dollars in local, state, and federal taxes.

Lead photo: Historic Abell Building, Baltimore. One of the thousands of historic structures rehabilitated with the federal tax credit.