The 444th session of the Maryland General Assembly begins today. This session still may not look like those of years past due to Covid-19 precautions, Preservation Maryland remains ready to be the voice of historic preservation in Annapolis. We are hitting the ground running with a full slate of priorities in support of historic tax credits, community revitalization, preservation funding, and smart growth.

2022 Priority Issues

Historic Rehabilitation Tax Credit

The revitalization of Maryland communities is fueled by the Historic Revitalization Tax Credit program. With the state budget in surplus going into session, now is the time to significantly fund this ready-made community investment tool. This session, Senator Cory McCray and Delegate Eric Luedtke have introduced legislation that will annually fund the Small Commercial program and increase funding for the Competitive Commercial program of this effective community redevelopment tool. Additionally, Delegate Al Carr has introduced legislation to make the Homeowner program more equitable and valuable.

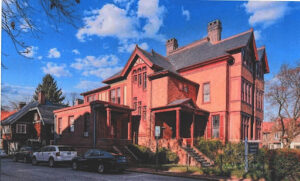

Randall House in Annapolis | Photo from Maryland Historical Trust

COMMUNITY REDEVELOPMENT AND HISTORIC PRESERVATION

Historic Revitalization Tax Credit – Funding and Extension (SB289/HB27)

We recognize the positive impact that historic preservation projects can have for the surrounding community. Unfortunately, one of the key programs that encourages such projects has been depleted of funding. The Small Commercial Historic Tax Credit program provides essential assistance to small business and developers who are looking to rehabilitate small, Main-Street type historic structures. During the 2021 legislative session, Preservation Maryland, along with our supporters, successfully advocated to extend the life of this essential community investment program with $1 million in additional funding.

Unfortunately, because the program has been so successful, it has once again completely run out of funding. It has been the backbone for many Main Street projects across the state and now has the potential to be used to transform vacant houses into vibrant historic homes for many for whom home ownership had long been out of reach. But, without more funding to the program, these shovel-ready projects will not be able to move forward.

Recognizing the real need for this program, the forthcoming legislation will create the Small Commercial Project Trust Account and annually fund it at $4 million.

Unlike the Small Commercial program, the Competitive Commercial Historic Revitalization Tax Credit program must receive funding in the state budget every year. As of FY22, Maryland has invested only $9M for the year for the entire state. By comparison, Virginia invests nearly $100M annually, and West Virginia invests $30M. Maryland has fallen behind.

Since its creation in 1996, this 20% tax credit program for the rehabilitation of historic structures has invested over $400 million in brick-and-mortar commercial redevelopment projects across nearly every jurisdiction in the state, created nearly 30,000 jobs, and yielded nearly $3.5 billion in economic activity.

As the state is faced with deciding where to spend the budget surplus, it’s worth noting that, according to a recent report from the Abell Foundation, the state Historic Revitalization Tax Credit generates positive revenue for the state and increases local property tax revenues. When buildings are rehabilitated, they pay more in local taxes which support better schools, roads, and healthcare without the need for more state dollars. Funding this program is an investment not a giveaway.

Last year, with the help of our supporters, we were able to work with legislators to secure at least $12 million in funding for this program in FY23 and FY24.

Knowing the potential benefits the state would see with a well funded historic tax credit, the forthcoming legislation will also mandate funding of at least $24 million for FY25 and FY26 and at least $36 million for FY27 through FY31.

Preservation Maryland and our supporters have worked diligently to make policy changes to strengthen this essential revitalization tool. Without more funding for the program, those positive changes have little opportunity to make the intended impact for communities across Maryland. We stand ready to continue the fight for increased funding this year.

Making preservation more equitable

Historic Revitalization Tax Credit – Substantial Rehabilitation – Threshold Amount (HB202)

Historic Revitalization Tax Credit – Alterations – Qualified Rehabilitation Expenditures for Single-Family, Owner-Occupied Residences (HB539)

Two pieces of legislation this year will focus on making the residential historic tax credit program accessible for more income levels. The first of the bills, sponsored by Delegate Al Carr, would increase the value of the credit for homeowners looking to invest in their historic homes by restoring the 25% credit amount for the residential program. The second would lower the threshold of qualifying residential historic tax credit projects to $2,500 for those who have received the Homeowner’s Tax Credit in the last three years.

Preservation Legislation

Maryland Great Outdoors act (SB541/HB727)

In late 2021, the Maryland General Assembly convened the State Park Investment Commission to explore the challenges associated with the operation, maintenance, staffing and access to Maryland’s State Park system – and to identify next steps for improving the parks. This bill is the result of the hard work of that Commission and represents the greatest investment in our state parks in a generation.

This sweeping legislation creates and funds a pathway for a State Park system that addresses needs for acquisition, accessibility, and equity. It seeks to invest in the parks Maryland already has while looking to expand the portfolio to ensure all Marylanders have public access to open space. Preservation Maryland is supportive of the many laudable goals that would be achieved through the Maryland Great Outdoors Act, especially the investment in the preservation and maintenance of the vast number of historic and cultural resources in Maryland parks and the expansion to include the diverse histories of underrepresented communities.

Maryland Corps Program – Revisions (SB228/HB443)

This legislation focuses on bringing service opportunities across Maryland into the 21st century. Among many other worthy goals, it would create a Maryland Historic Trades Corps to place young adults and veterans in regionally based work crews across Maryland to rehabilitate the state’s historic resources.

One of the benefits of that is a large stock of historic structures and buildings in every corner of our state. Indeed, Maryland has tens of thousands of structures which contribute to historic districts listed on National Register of Historic Places, and every day, more buildings in Maryland become eligible for the Register as they age and become part of our collective history. Buildings on the National Register of Historic Places require work done to the Secretary of Interior Standards for Historic Preservation. Therefore, specialized training is needed to ensure work complies with these standards.

Unfortunately, there is currently a documented and severe shortage of trained preservation tradespeople. SB228 would help address this crisis by investing in workforce training in the traditional trades through a Maryland Historic Trades Corps program. Participants would gain valuable experience on historic preservation projects in the state of Maryland, and at the conclusion of their experience would be abundantly qualified to enter the private sector, begin a job with the State of Maryland, or join one of Maryland’s many trade unions to pursue a career in a variety of fields, including finish carpentry, frame carpentry, roofing, masonry and painting

Smart Growth Legislation

Maryland the beautiful act (SB791/HB1031)

This bill establishes a goal to protect 30% of Maryland open space by 2030 and 40% by 2040, works to make greenspace more equitable, and empowers land and forest conservation efforts.

Comprehensive cLIMATE solutions (HB708)

Climate Solutions Now Act of 2022 (SB0528)

The bill changes Maryland’s greenhouse gas reduction requirements to 60% below 2006 levels by 2032 and net-zero by 2045. The bill also calls on the Commission on Environmental Justice and Sustainable Communities to determine the percentage of state funds spent on climate change that must go to overburdened communities. It also creates a work group to protect impacted workers, as well as a Climate Justice Corps.

MARYLAND SUSTAINABLE BUILDINGS ACT OF 2022 (HB43)

The increase of glass in new building construction in Maryland, and worldwide, threatens to undo energy conservation efforts, costs the state money, and contributes to climate change, while also causing the deaths of an estimated 1 billion birds annually in the United States, who fly into buildings, bridges, and other manmade structures.

This bill would require the Maryland Department of General Services to establish standards for state buildings and those buildings with 51% or more state funding to reduce the amount of energy-inefficient and bird-dangerous glass. Glass greater than 10% of the first 40 feet of building facades and 40% above 40 feet would need to be shaded, screened, or patterned with visible or UV films, frits, or etching. Such standards would reduce energy costs and reduce bird fatalities by more than 90%. Lighting during non-operational night times would also be limited to save energy and reduce bird attraction.

COnstitutional Amendment – Environmental rights (HB596/SB783)

An amendment to the Maryland Constitution that would establish that every person has an inalienable right to a healthful environment, including the right to clean air, water, and land, a stable climate, and the preservation, protection, and enhancement of ecological, scenic, and historic values of the environment. It establishes the State as the trustee of the natural and historic resources of the State. The implications of this amendment, if passed, is that citizens would have the right to intervene in an action brought by the State or a political subdivision to protect those natural and historic resources.

Program Open Space

Cylists and walkers on Beach Drive Parkway in Montgomery County, MD, 2020. Photo from Partners for Open Space.

In 1969, the Maryland General Assembly created Program Open Space through the institution of a transfer tax of .5% on every real estate transaction in the state. Since then the program has been responsible for:

- 319,000 acres of open space for state parts and natural resource areas,

- Creation and funding of the Maryland Heritage Areas Authority and heritage area grants,

- More than 6,100 individual county and municipal parks and conservation areas,

- 31,000 acres of local park land,

- 31 Rural Legacy Areas, preserving 77,000 acres,

- 286,000 acres of farmland under Maryland Agricultural Land Preservation Foundation easement.

The Maryland Heritage Areas Authority is funded by Program Open Space. Preservation Maryland supports full funding of Program Open Space and the Heritage Area Authority, opposes any attempts to shortcut, reduce, or cap the program in any way, and we support the repayment of previous diversions from the fund.

Budget Priorities

Budget Bill – Fiscal Year 2023 (HB300/SB290)

The state of Maryland is in a better financial position going into the 2022 session than it has been in years. While this is certainly good news, there will be stiff competition as many different interests vie for the funding in the FY23 Budget. Every year the Governor presents a Capital and Operating Budget that the General Assembly must then work with and pass by the end of session in April. There is no better time than now to adequately fund preservation programs, so making a strong case for this essential funding for preservation grant programs will continue to be a priority for Preservation Maryland over the coming session. Once the Governor releases his Budget at the end of January, we will have a better sense of where these programs stand – and what we will need to advocate for.