Preservation Maryland has partnered with a national leader in energy conservation and efficiency financing to help provide flexible funding for preservation and infill projects throughout the state and beyond.

The financing is known as C-PACE (Commercial Property Assessed Clean Energy). This innovative financing tool fills equity financing gaps in complex development projects – and the cost of PACE financing is often more than 50% less expensive than traditional mezzanine debt.

unique and flexible financing

The financing is repaid through a fixed tax assessment on the structure. Eligible Properties include: Industrial, Office, Retail, Multi-Family, Mixed-Use. Project costs must be $250,000+. This unique tax assessment model provides the following benefits:

- C-PACE programs allow for funding up to 20% of the as-stabilized value of the building.

- May allow pass-through on NNN leases and room surcharges.

- Non-recourse, fixed rate and long terms.

- Cannot be accelerated (called due).

- Construction through term financing.

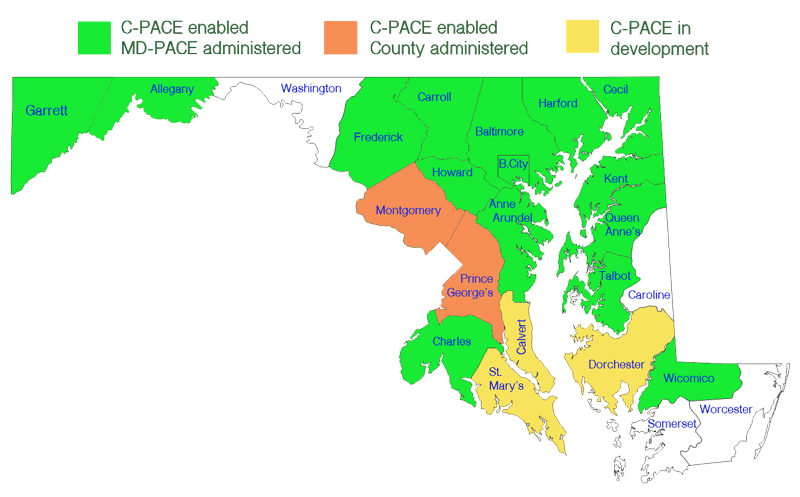

C-PACE eligible counties in Maryland.

Eligible Project Types

- Solar energy

- Solar for non-profits

- Boilers, chillers & furnaces

- Automated building controls

- HVAC systems

- Roof replacement

- High efficiency lighting

- Hot water heating systems

- Variable speed drives

- Water conservation

- Resiliency measures

- Building envelope

Get More Information

To learn more about this financing opportunity and to be put in touch with Preservation Maryland’s C-PACE lending partner, contact Preservation Maryland here.

Learn more about C-PACE Financing

LEGAL DISCLAIMER: Preservation Maryland and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should always consult your own tax, legal and accounting advisers before engaging in any transaction.