Historic Preservation and Smart Growth in Maryland: Balancing Heritage & Density

Smart Growth advocates and historic preservationists share a common affinity for many land use and real estate development issues here in Maryland including revitalization of historic downtowns, protecting open space, support for mass-transit, and more. Governor Wes Moore’s recently unveiled 2024 State Plan cited a 100,000 statewide housing unit deficit. In late 2023, Secretary of Housing and Community Development, Jake Day, told the House Environment and Transportation Committee the Department is planning for “decisive action” to tackle the shortage. The tenets of historic preservation and Smart Growth have a lot to contribute as communities across Maryland determine where and how this needed density of housing units is added to the built environment.

Understanding Smart Growth

Smart Growth is a planning approach that focuses on sustainable, environmentally responsible, and economically viable development. It emphasizes compact, transit-oriented, walkable, and bike-friendly communities, with a variety of housing options. The goal is to create livable, equitable, and economically robust communities while reducing sprawl and its associated environmental impacts.

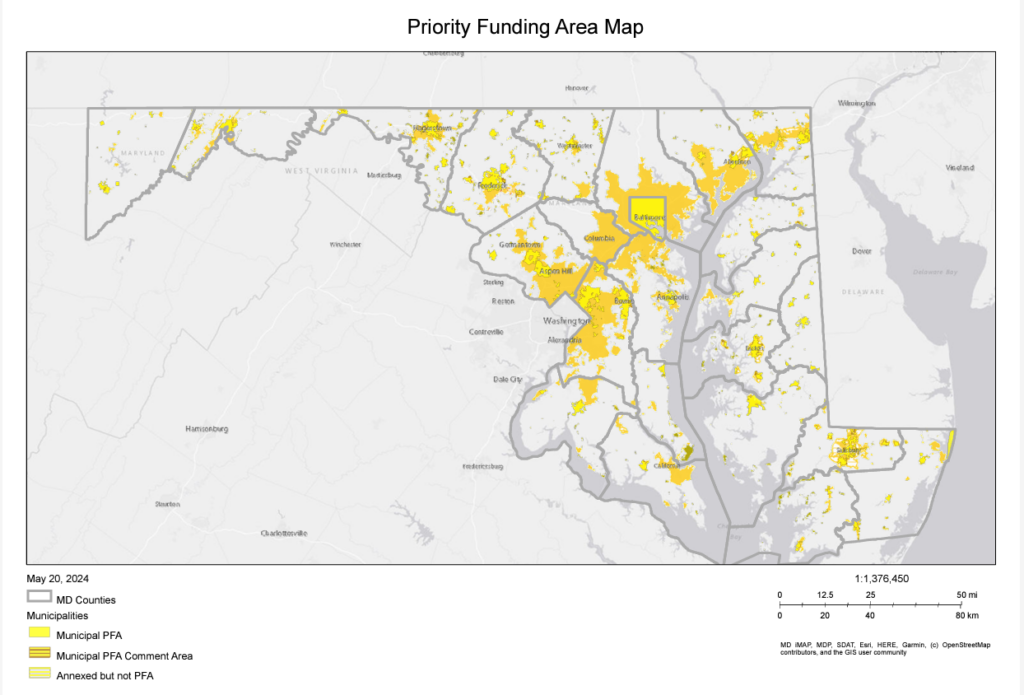

In Maryland, the Smart Growth initiative began in earnest with the Smart Growth and Neighborhood Conservation Act of 1997. This legislation aimed to direct state resources to support growth in existing communities, protect rural areas, and curb urban sprawl. The act introduced the concept of Priority Funding Areas (PFAs), which are designated regions where the state concentrates its funding for development projects to maximize efficiency and sustainability.

Figure 1. Official Map of the Priority Funding Areas. Maryland Department of Planning.

The Role of Historic Preservation

Maryland, with its storied past, has a wealth of historic resources, from colonial-era structures to battlefields and landmarks of the Civil Rights Movement. Preserving these sites is crucial for maintaining the state’s cultural heritage and fostering a sense of identity and continuity. There are over 1,500 resources listed on the National Register of Historic Places in Maryland. Additionally, there are 23 certified local governments in Maryland, a designation by the National Park Service for communities who facilitate municipal preservation programs. These National Register and local historic districts represent a tiny portion of the older, compact, walkable communities that dot the landscape across Maryland. A recent publication by PlaceEconomics showed that Baltimore’s local historic districts – covering only 3% of the city land area – are twice as dense as non-designated residential areas. Even still, historic neighborhoods, even those with local design control, are ripe for gentle density and increased growth through a variety of strategies.

Integrating Historic Preservation & Smart Growth

As Maryland continues to grow, the principles of Smart Growth and the state’s PFAs offer a framework that supports concentrating growth in those areas. This presents both an opportunity and a vulnerability for historic properties, districts, and landscapes across the state. Maryland has done a tremendous job of preserving open space; however, as development is pushed into existing communities, how it is achieved and what impact it may have on existing historic communities are major questions.

While many pre-World War II communities are in fact already “dense,” the typical age of historic designation consideration at 50 years is now 1973. The post-World War II era is known for sprawl, Ranch subdivisions, and strip centers. As more and more of those older sprawl communities are designated as historic, how do we densify them in a sensitive manner? This balancing act will be critical in maintaining the state’s unique character while accommodating modern development needs.

So, how can historic preservation and Smart Growth work together effectively to facilitate this balancing act?

Adaptive Reuse: One of the most effective strategies is adaptive reuse, which involves repurposing old buildings for new uses. This not only preserves the architectural and historical integrity of structures but also contributes to sustainable development by reducing the need for new construction. The federal historic tax credit has been used to transform old mills into residential and commercial spaces. Legacy cities like Cumberland are ripe for adaptive reuse of underutilized historic buildings. A recent CBS News article cited Baltimore’s 13,000 vacant homes and more than 20,000 vacant lots. These vacancies in areas with existing public infrastructure are low-hanging fruit for adding density.

Figure 2. 52 Poplar Street in Cambridge is being renovated, including adding upper floor housing as part of a Maryland Historic Rehabilitation Tax Credit project. ARQ Architects/Eli Pousson.

Urban Infill: Focusing on new construction urban infill in existing urban centers is critical. By directing development to cities and towns with established infrastructure, Maryland can reduce sprawl and protect rural landscapes. Adding gentle density like building duplexes, triplexes, and quads – instead of single-family – and accessory dwelling units (ADUs) will bring more needed housing units online. Additionally, existing historic districts already exhibit this type of hidden density and can easily accommodate more in a sensitive manner.

Figure 3. A diagram by architect Eric Kronberg shows the possibilities of gentle density with a fourplex and several ADUs on four 50’ by 100’ lots. Eric Kronberg.

Incentives and Support: Maryland offers a variety of tax credit incentives and economic development programs to encourage historic preservation and Smart Growth development. The Maryland Historic Revitalization Tax Credit program, established in 1996 provides a tax credit to a property owner in exchange for the substantial rehabilitation of an eligible historic property. A 2020 Abell Foundation economic impact study showed that each $1 of tax credit invested yields the state $8.13 in total economic output. The recently passed Just Communities Act ensures state resources, like funding and services, are allocated in a manner that prioritizes historically underserved and marginalized communities in PFAs. This bill has great potential to support equitable development and preservation of existing housing through the lens of historic preservation and Smart Growth. The Maryland legislature also passed HB2 which gives municipalities the authority to impose special property tax rates on vacant and abandoned properties, incentivizing property owners to maintain and rehabilitate these spaces. This “stick” of higher property taxes on vacant property is designed to nudge the owner to more effectively utilize their property – like perhaps building housing. Combined – the “carrots” and “sticks” to encourage historic preservation and Smart Growth, existing historic resources, and vacant lots ripe for infill – have the potential to significantly address the housing deficit in Maryland.

Implementing the approach of prioritizing adaptive reuse, urban infill, and incentive programs to focus investment in those spaces will support the development and preservation of needed housing units across Maryland. The balancing act of heritage and density doesn’t appear to be an act after all – but a viable solution.