As a result of Preservation Maryland and its many partners’ ongoing advocacy, six projects across Maryland recently received over $9 million in historic tax credit funding. As a result, over $73 million worth of projects will move forward – underscoring the significance of preservation advocacy and power of revitalization incentives.

HISTORIC TAX CREDITS MAKE A DIFFERENCE IN MARYLAND

The Hogan administration announced that the Maryland Historical Trust (MHT), a division of the Maryland Department of Planning, awarded more than $9 million in tax credits to leverage more than $64 million in additional investment and create more than 700 jobs. The six applications selected in a competitive process for the 2022 tax credits are based on an established set of criteria, including those outlined by the U.S. Secretary of the Interior Standards for historic building rehabilitation.

- Wilkins Rogers Mill, Frederick Road, Baltimore County

- Becker Bros. / Gieske & Niemann Tobacco Warehouse, North Washington Street, Baltimore City

- Eastern Health District/Huntington Williams Building, 620 N. Caroline Street, Baltimore City

- Randall House, 86 State Circle, Anne Arundel County

- Updegraff Building, West Washington Street, Washington County

- Earles Building (aka Holly Building), West Washington Street, Washington County

The Historic Revitalization Tax Credit, administered by MHT, has invested more than $425 million in Maryland rehabilitation projects since it began in 1996. The investments have helped improve 5,194 homeowners and 796 commercial historic structures, preserving buildings that contribute to the distinct character of Maryland’s towns, cities, and rural areas.

Maryland Secretary of Planning Rob McCord noted that “Planning supports historic rehabilitation while advancing community revitalization and economic development. This funding helps encourage the preservation and adaptive re-use of historic buildings and enhances the enjoyment of our state’s history, culture, and scenic beauty”.

“The tax credits will help revitalize communities, strengthen Maryland’s economy, and bring new housing, commercial, and arts opportunities throughout our state,“ said Governor Larry Hogan. “Our administration is proud to provide this funding, which will preserve Maryland’s historic buildings for future generations to come.”

DEMAND FOR CREDITS continues to FAR OUTSTRIP STATE APPROPRIATION

The lack of funding has been a chronic issue for Maryland’s state historic tax credit program, and as the buying power of a $9 million credit is reduced, fewer and fewer projects can receive the funding they need.

Preservation Maryland Director of Government Relations Elly Cowan addressed the challenge and explained that: “We are very pleased to see this latest round of projects receive funding. Unfortunately, we remain concerned at the starvation level funding of this program at $9 million for all of Maryland. We successfully advocated for legislation last session that will mandate a minimum of $12 million in funding for this program beginning in FY24, but Maryland can and must do better moving forward if we are serious about investing in our state’s future and competing regionally. We look forward to continuing the fight to fully fund this essential redevelopment program that encourages investment in community revitalization projects across the state. Studies have shown that the credit is a job creator and that for every $1 in historic tax credits invested, the state sees a return of $8.13 in economic activity. In light of the continued challenges facing Maryland’s economy, the importance of Maryland’s Historic Revitalization Tax Credit to the financial recovery of the state cannot be overstated.”

Preservation Maryland Director of Government Relations Elly Cowan addressed the challenge and explained that: “We are very pleased to see this latest round of projects receive funding. Unfortunately, we remain concerned at the starvation level funding of this program at $9 million for all of Maryland. We successfully advocated for legislation last session that will mandate a minimum of $12 million in funding for this program beginning in FY24, but Maryland can and must do better moving forward if we are serious about investing in our state’s future and competing regionally. We look forward to continuing the fight to fully fund this essential redevelopment program that encourages investment in community revitalization projects across the state. Studies have shown that the credit is a job creator and that for every $1 in historic tax credits invested, the state sees a return of $8.13 in economic activity. In light of the continued challenges facing Maryland’s economy, the importance of Maryland’s Historic Revitalization Tax Credit to the financial recovery of the state cannot be overstated.”

Awarded Tax Credit Projects

Wilkins Rogers Mill

Frederick Road, Baltimore County

$3 Million in tax credits awarded towards a $35 Million project

Located on the site of the historic Ellicott Brothers’ Grist Mill, the Wilkins Rogers Mill sits on the banks of the Patapsco River, across from the historic core of Ellicott City. The current mill complex dates from 1916-1917, with additions made in 1918, and 1941, and features large silos both on the exterior and interior. It remained in operation until 2020, and was the last active flour mill in the state. Historically an industrial complex, it will be rehabilitated into a mixed-use property with residential apartments and amenities, retail spaces, a restaurant, and a small museum highlighting the history of the site and the importance of flour production in the surrounding region.

Becker Bros. / Gieske & Niemann Tobacco Warehouse

North Washington Street, Baltimore City

$1.75 Million in tax credits awarded towards a $7 million project

Constructed in 1875 by the Becker Bros. of Baltimore, this three-story Classical Revival warehouse with cast-iron and brick ornamentation has been in light industrial use since its construction, specifically for the tobacco industry. Its location next to the railway line and three blocks from Gay Street, East Baltimore’s main commercial and industrial corridor, made it convenient for importing and exporting raw and finished materials. The project will rehabilitate the existing building into updated commercial space, accommodating new commercial and retail programming.

Eastern Health District/Huntington Williams Building

620 N. Caroline Street, Baltimore City

$3 Million in tax credits awarded towards a $15 million project

The City of Baltimore constructed the Eastern Health District/Huntington Williams Building in 1953-1954 based on designs by Baltimore architect Charles Dana Loomis. Established in 1932, the Eastern Health District formed from a partnership between the Johns Hopkins School of Hygiene and Public Health and the Baltimore City Health Department. The building, named after former Baltimore City Health Department Director Huntington Williams, is an excellent example of the International style with clean modernist lines, a low horizontal massing, ribbon windows, and high-quality materials, including limestone and black serpentine. The modernist design reflects the spirit of progress, optimism, and technology of the mid-20th century. This project will convert the vacant office building into laboratory and office spaces.

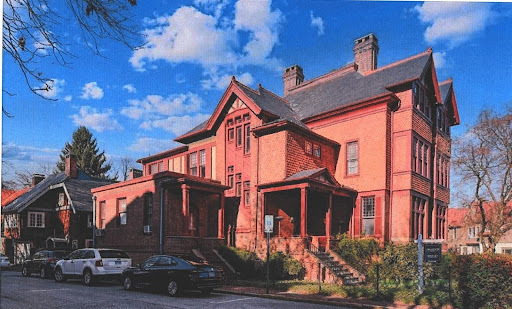

Randall House

86 State Circle, Anne Arundel County

$194,074 in tax credits awarded towards a $970,370 project

Located in the Colonial Annapolis Historic District, and facing the Maryland State House, 86 State Circle is a significant example of Queen Anne/Eastlake- style architecture. The building (a duplex) is one of the first of several large residences situated to face the circle and North Street. It survives as a significant example of the influence British architecture had in the late-19th century, and a well-designed addition on the North Street side dates to the mid-20th century. The project will convert one side of the duplex into a boutique hotel by removing non-historic interior partitions and adding new partitions to create nine guest suites. The windows and exterior features will be cleaned and repaired as necessary.

Updegraff Building

West Washington Street, Washington County

$847,957 in tax credits awarded towards a $3.39 million project

Located in the Hagerstown Commercial Core Historic District and built in 1882, this commercial building once housed a department store, and the upper floors may have housed a glove production operation. Its front façade is remarkably intact with Eastlake design elements, an original metal cornice at the top, and decorative brickwork. The building will be converted into apartments with a restaurant and brewery on the ground floor.

Earles Building (aka Holly Building)

West Washington Street, Washington County

$394,121 in tax credits awards towards a $12.5 million project

This Tudor Revival commercial building, constructed in 1926, features cast stone decorative elements at the top of the Washington Street façade and a crenelated parapet that was added in the 1930s. Owners have modified parts of the building – most notably its storefront – over time, but the historic steel windows remain intact throughout the building. The building housed several department stores and discount retail chains on the ground floor with rental office spaces available on the upper floors. It will be rehabilitated into apartments with a commercial space on the ground floor.