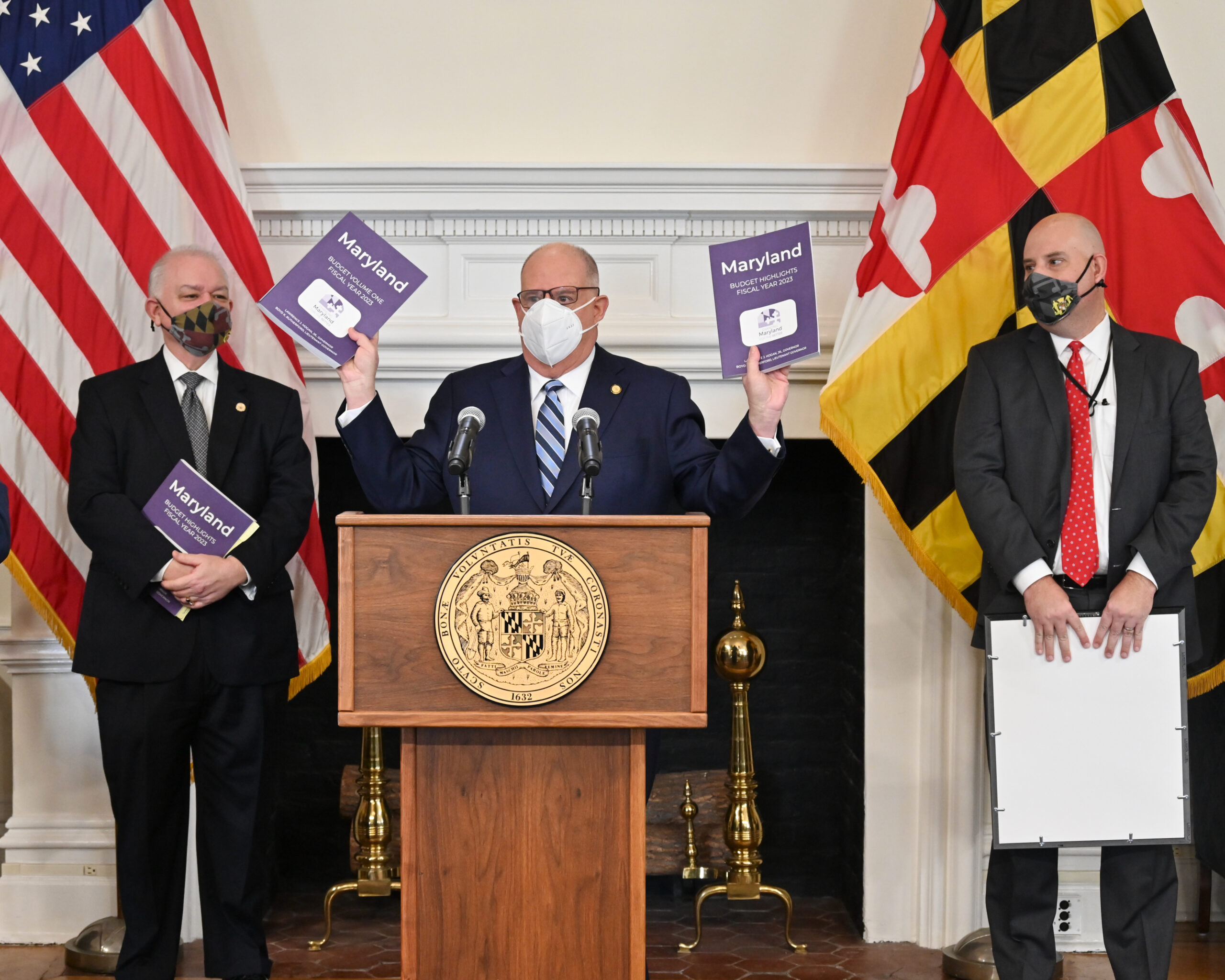

Governor Hogan’s newly released FY23 budget includes an increase in funding for the Historic Revitalization Tax Credit and level funding for several other essential preservation programs.

For the first time in nearly a decade, the Governor’s budget includes increased funding of $12M for the Competitive Commercial program of the Historic Revitalization Tax Credit (HTC). Funding for the key community revitalization program had been stalled at $9M, but thanks to legislation Preservation Maryland and our partners helped pass last year, the Governor is now mandated to include $12M for the program in FY23 and FY24.

While we are grateful to see the HTC receiving $12M, it’s still a far cry from neighboring Virginia’s $100M or even West Virginia’s $30M. Considering the proven 8:1 return on investment to the state and the potential economic and community revitalization that comes as a result of historic tax credit projects, the continued starvation-level funding to the program seems short-sighted especially when the state needs to be investing in stimulating economic recovery and job creation.

Preservation Maryland is currently working with key decision makers to advance legislation this year that would increase the mandated funding to $24M in FY25-26 and to $36M in FY27-31. Additionally, the bill would annually fund the Small Commercial program of the HTC that has run out of money and can no longer issue credits.

The Governor’s budget also includes level funding for several other preservation programs:

- Full funding for Program Open Space

- $600k for Maryland Historical Trust capital grants

- $6 million for the Maryland Heritage Area Authority

NEXT STEP: ADVOCACY

While these programs are funded in the Governor’s budget, there is no guarantee that that funding will be retained in the final version passed by the Maryland General Assembly before the end of Session in April. Preservation Maryland and our supporters stand ready to defend these programs as the budget moves through the legislative process.